what is the salt deduction repeal

Almost all 96 percent of the benefits of. Second the 2017 law capped the SALT deduction at 10000 5000 if.

House Panel Votes To Temporarily Repeal Salt Deduction Cap The Hill

The Tax Cuts and Jobs Act.

. The lawmakers have asked. The push to repeal this cap a few. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. Policymakers are considering other options to reform or repeal the SALT deduction cap.

But you must itemize in order to deduct state and local taxes on your federal income tax return. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. The benefits of the SALT deduction overwhelmingly go to high-income taxpayers particularly those in high-income and high-tax states.

What is the salt deduction repeal. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. House Votes to Temporarily.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing. Reeves and Christopher Pulliam Thursday June 24 2021.

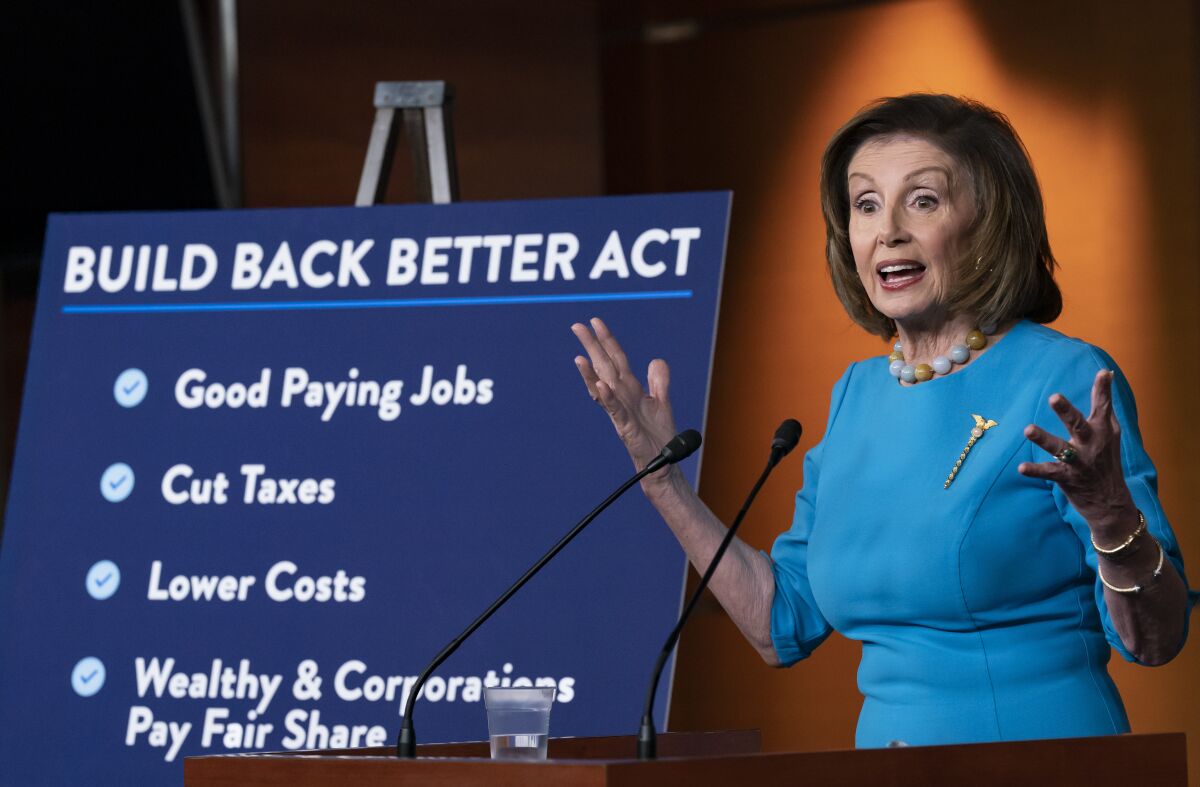

Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the. Senator Bernie Sanders appears to have changed his mind on the deduction for state and local taxes. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better.

Tax Policy Center. Nita Lowey D-NY and Rep. For example the 10000 SALT cap could be doubled for joint fillers who.

Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT. A growing rift among Democrats over whether to repeal a Trump-era limit on state and local tax deductions is threatening to derail President Biden s 225 trillion tax and. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes.

Peter King R-NY introduced a bill in the House of Representatives to repeal the 10000 cap on the state and local deduction SALT. The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on. For your 2021 taxes which youll file in 2022 you can only itemize when your.

The SALT deduction benefits only a shrinking minority of taxpayers. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

Nj Congressional Delegation Members Fighting To Repeal The Cap On Salt Deduction Oppose Reconciliation Unless Salt Deduction Restored Wrnj Radio

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

Bernie Sanders Is Mostly Right About The Salt Deduction

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Marc Goldwein On Twitter 96 Of The Benefit Of The Salt Cap Deduction Repeal Would Go To Folks In The Top Quintile This Is Not A Middle Class Tax Cut Https T Co 2xnupxnvhd

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

House Likely To Act Soon To Restore Salt Deduction Crain S Chicago Business

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Lawmakers Offer Bill To Repeal Cap On Salt Deduction The Hill

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

Some Democrats Want To Repeal Salt Tax Deduction Cap But Others Say That S A Tax Cut For The Rich Cbs News

Democratic Senators Look To Repeal Salt Deduction With Special Vote Fox Business

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Detaxify Tax Relief Experts Tax Resolution Irs Debt

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Why Repealing The State And Local Tax Deduction Is So Hard Tax Policy Center